1. History and Founding

Apple Inc. was founded on April 1, 1976, by Steve Jobs, Steve Wozniak,

and Ronald Wayne in Cupertino, California, USA. The company started as

a personal computer manufacturer with the release of the Apple I and

later the Apple II, which became one of the first mass-produced

personal computers.

In 1984, Apple introduced the Macintosh, revolutionizing the computing

industry with a graphical user interface. However, internal conflicts

led to Steve Jobs leaving the company in 1985. Apple struggled in the

1990s but saw a massive turnaround when Jobs returned in 1997. He

introduced a series of groundbreaking products, including the iMac,

iPod, iPhone, and iPad, transforming Apple into a tech giant.

Today, Apple is one of the world’s most valuable companies, known for

its innovation, premium branding, and strong ecosystem of products and

services.

2. Sector and Industry

Apple operates in the broader technology sector and is a key player in

several multi-billion-dollar industries. At its core, Apple is a

consumer electronics company—but its reach extends far beyond devices.

It competes in software, cloud services, digital payments, streaming,

and health tech. This cross-industry presence is what makes Apple

unique.

Apple’s ecosystem spans devices, software, services, and media

platforms.

Its main areas of operation include:

-

Consumer Electronics: iPhone, Mac, iPad, Apple

Watch, and AirPods are among the world’s best-selling devices.

-

Software & Services: iOS, macOS, iCloud, and

Apple’s app ecosystem serve over 2 billion active devices.

-

Digital Media & Payments: Apple TV+, Apple Music,

and Apple Pay compete with Netflix, Spotify, and PayPal.

Apple's services segment includes Apple Music, TV+, iCloud, App

Store, and more.

Apple’s closest competitors include tech giants like Microsoft, Google

(Alphabet), Samsung, Amazon, and Meta. Its ability to operate across

industries gives it a strategic edge that few can match.

3. Revenue Streams – How Apple Makes Money

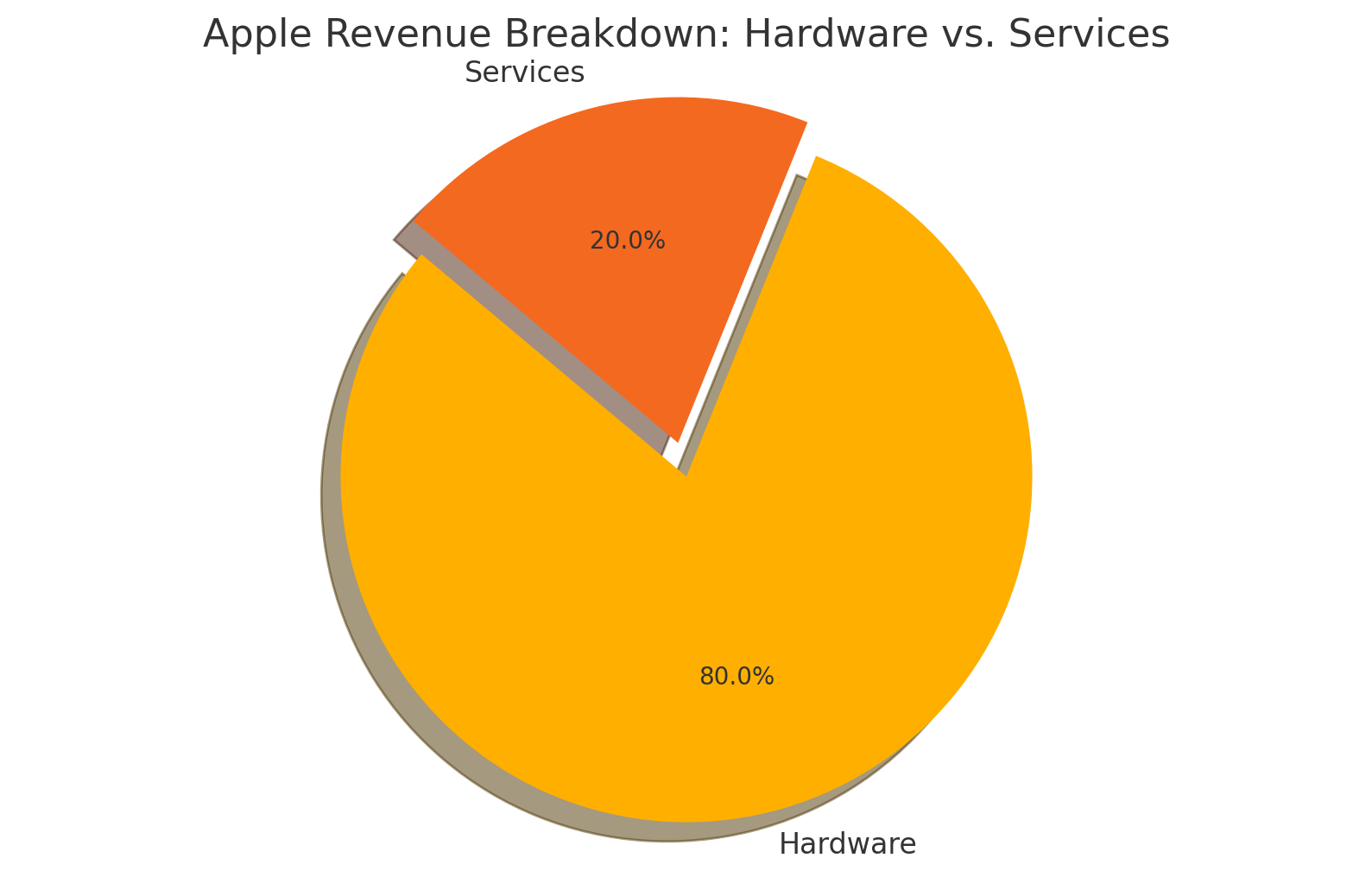

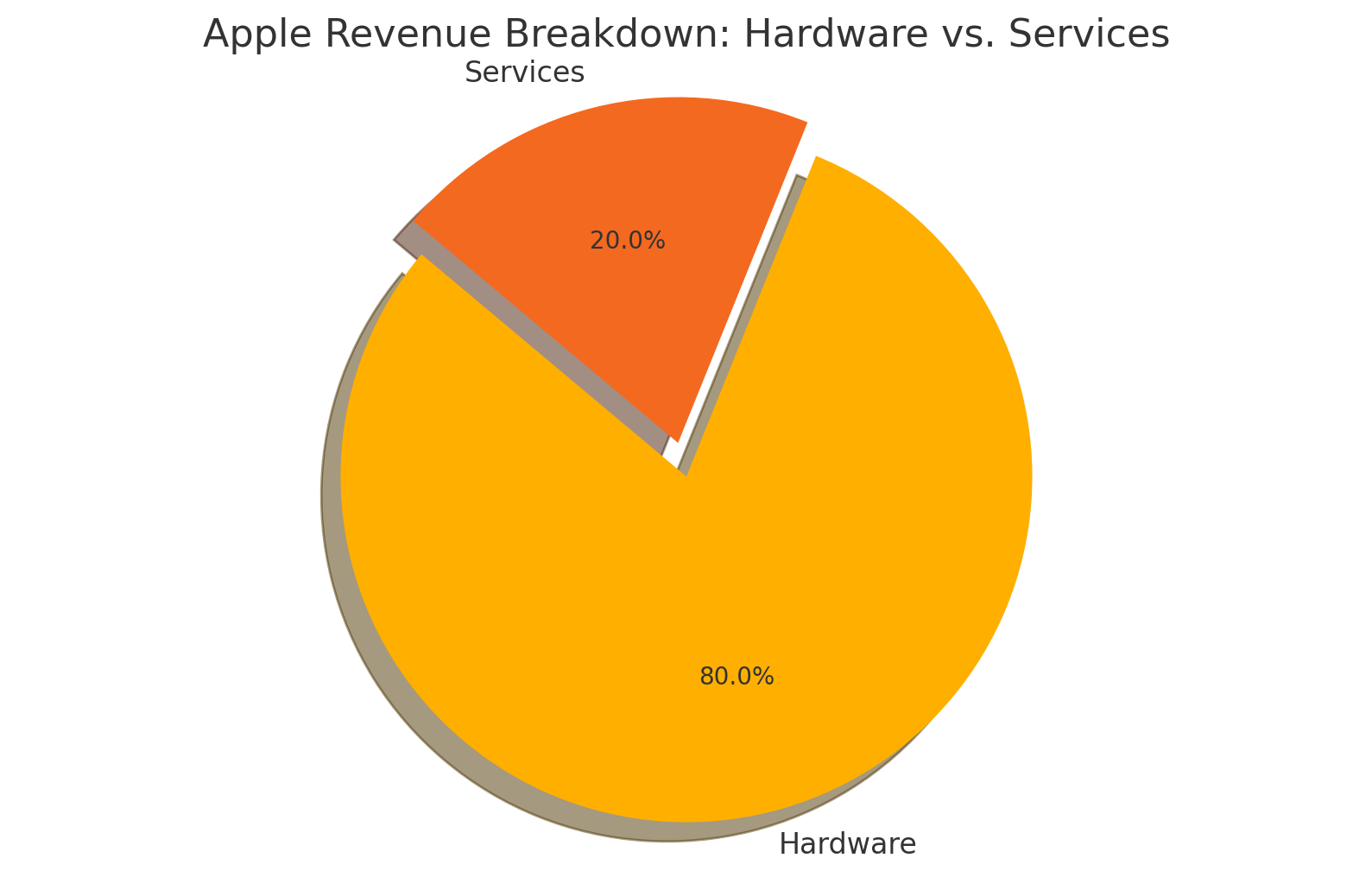

a) Hardware Sales (Major Contributor - ~80% of Revenue)

-

iPhone – The biggest revenue driver, accounting for ~50% of sales

- Mac & iPad – Premium computers and tablets

- Wearables & Accessories – AirPods, Apple Watch, HomePods

Apple’s revenue is driven mostly by hardware, with services gaining

ground.

b) Services (Fastest Growing - ~20% of Revenue)

- App Store & In-App Purchases – 30% commission on app sales

-

Subscription Services – Apple Music, iCloud, Apple TV+, Apple Arcade

- Apple Pay & Financial Services – Growing revenue stream

Apple’s subscription business is growing rapidly, providing recurring

revenue and reducing reliance on hardware sales.

4. Competitive Advantage & Strengths

-

Strong Brand Loyalty – One of the most recognized and trusted brands

globally.

-

Ecosystem Effect – Seamless integration between iPhones, Macs,

iPads, and services keeps customers locked in.

-

High Profit Margins – Apple has some of the best margins in the

industry due to premium pricing.

-

Continuous Innovation – Investment in R&D ensures Apple remains a

leader in tech.

-

Cash Reserves & Strong Financials – Apple has one of the largest

cash reserves among corporations, allowing flexibility in

investments, acquisitions, and shareholder returns.

5. Strategic Ecosystem & Partnerships

Apple’s strength lies not only in its products but also in its

extensive network of partners and a deeply integrated ecosystem. These

relationships enhance scalability, performance, and customer loyalty.

Key Partners:

-

Foxconn & TSMC: Critical manufacturing and chip

design partners.

-

App Developers: The App Store thrives thanks to

millions of independent developers.

-

Financial Institutions: Partners like Goldman Sachs

help power services like Apple Card and Apple Pay.

-

Content Providers: Partnerships for Apple TV+

original content and distribution.

Owned Ecosystem:

-

Operating Systems: iOS, macOS, watchOS, iPadOS –

all controlled by Apple.

-

Apple Silicon: Custom chips (M1, M2) designed for

high performance and efficiency.

-

Digital Services: iCloud, Apple Music, TV+, Arcade,

Fitness+.

This ecosystem strategy ensures Apple retains control over user

experience, reduces dependencies, and drives high-margin recurring

revenue through services.

6. Risks & Challenges for Investors

-

Dependence on iPhone Sales: The iPhone still

generates over half of Apple’s revenue. Any slowdown in global

smartphone demand or iPhone upgrades could impact financial

performance.

-

Regulatory Scrutiny: Apple faces increasing

antitrust investigations in the U.S., EU, and other

regions—particularly around App Store practices and competitive

fairness.

-

Supply Chain Vulnerabilities: Heavy reliance on

Chinese manufacturing exposes Apple to risks from geopolitical

tensions, pandemics, or labor disruptions.

-

Market Saturation: In developed countries, most

people already own smartphones and computers, making it harder for

Apple to grow hardware sales significantly.

-

Environmental & Ethical Pressure: Investors are

watching how Apple handles e-waste, carbon neutrality goals, and

sourcing materials ethically.

7. Future Growth Opportunities

The Apple Vision Pro represents Apple’s entry into spatial computing

and immersive technology.

-

Augmented & Virtual Reality (AR/VR): The Apple

Vision Pro headset is Apple’s bold first step into spatial

computing. This market could reshape how users consume media, work,

and communicate.

-

Artificial Intelligence (AI): Apple is investing

heavily in on-device AI. With major updates coming to Siri and iOS,

the company aims to integrate AI deeply into its user experience

without compromising privacy.

-

Electric Vehicles (EVs): Though the “Apple Car”

project remains secretive, any entry into autonomous or electric

mobility could open a massive new revenue stream.

-

Healthcare & Wearables: The Apple Watch and Health

app are evolving into powerful tools for preventive care,

diagnostics, and health tracking, potentially disrupting traditional

healthcare models.

-

Emerging Markets: Apple's growth in India and

Southeast Asia is a key opportunity as millions of consumers enter

the middle class and seek premium tech.

-

Subscription Ecosystem: Apple’s expanding lineup of

subscription services—like Music, iCloud+, and Fitness+—build

recurring revenue and customer lock-in, boosting long-term financial

stability.

8. Conclusion – Why Investors Care

Apple remains one of the most valuable and influential companies in

the world—not just because of its products, but because of its brand

strength, financial discipline, and constant innovation. Its tight

ecosystem, loyal customer base, and growing service revenues give it

long-term resilience, even in competitive or uncertain markets.

While Apple faces challenges such as regulatory pressure and market

saturation, its strategic focus on privacy, sustainability, and

emerging technologies like AI and AR/VR positions it well for future

growth. For investors, Apple offers a rare blend of profitability,

stability, and innovation that continues to shape the global tech

landscape.