1. History and Founding

Microsoft was founded on April 4, 1975, by childhood friends Bill

Gates and Paul Allen in Albuquerque, New Mexico. The company started

by developing a BASIC interpreter for the Altair 8800, one of the

earliest personal computers. In 1981, Microsoft partnered with IBM to

provide the MS-DOS operating system, laying the groundwork for its

rise in personal computing. A major breakthrough came in 1985 with the

launch of Windows, offering a graphical interface that made computers

more user-friendly.

Throughout the 1990s and 2000s, Microsoft became synonymous with

office software and operating systems. The introduction of Microsoft

Office, Internet Explorer, and Windows XP solidified its global

dominance. More recently, under CEO Satya Nadella, the company shifted

to a cloud-first strategy, launching Azure and acquiring LinkedIn,

GitHub, and investing in OpenAI. Today, Microsoft stands as one of the

most influential and valuable companies in the world.

2. Sector and Industry

Microsoft is a global leader in the technology sector, operating

across a wide range of industries. Its business spans software

development, cloud computing, artificial intelligence, gaming,

enterprise solutions, and productivity tools. As a foundational player

in shaping the modern digital ecosystem, Microsoft builds both

consumer-facing products and backend infrastructure for businesses and

governments alike.

-

Software & Operating Systems: Windows, Office 365,

Visual Studio, and developer tools used worldwide.

-

Cloud Computing: Microsoft Azure powers businesses,

AI services, and government institutions.

-

Gaming: Xbox, Game Pass, and game development via

Activision Blizzard and Xbox Game Studios.

-

Enterprise Solutions: Microsoft Teams, Dynamics

365, Power Platform, GitHub, and LinkedIn.

Microsoft competes with tech giants like Amazon (AWS), Google (Cloud &

Docs), Apple (Devices & OS), and Salesforce (CRM) across multiple

business lines, making it one of the most diversified and

strategically positioned companies in the world.

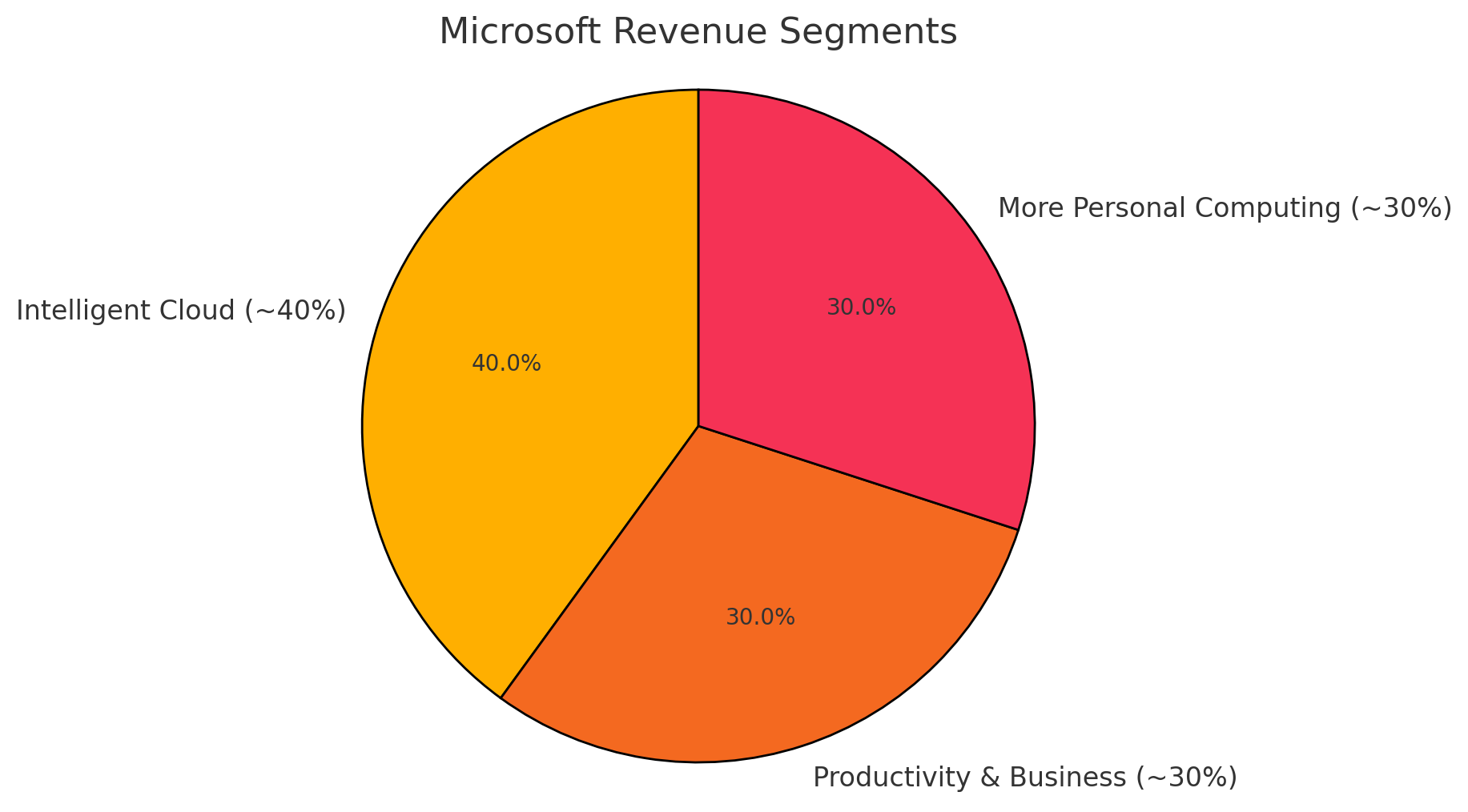

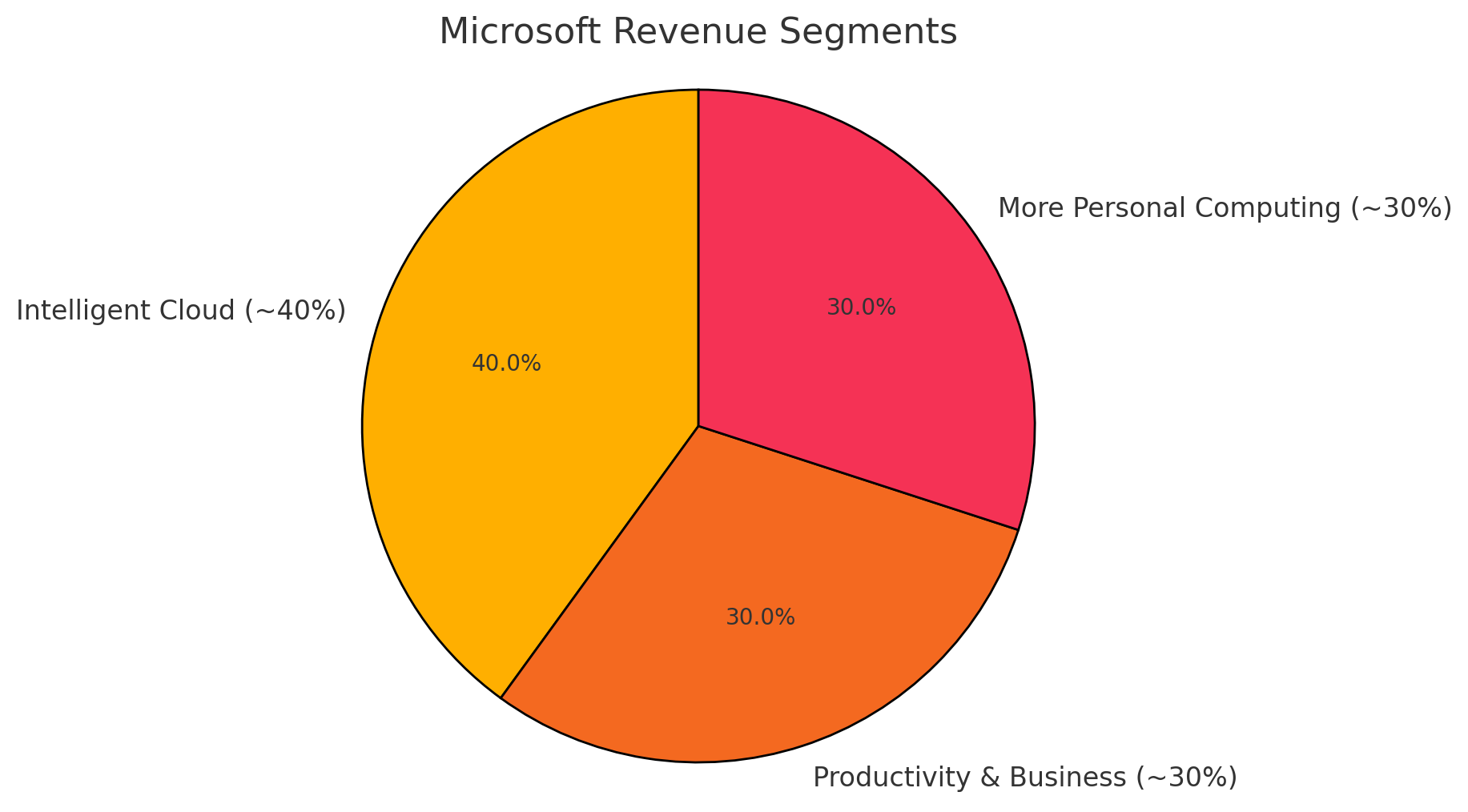

3. Revenue Streams – How Microsoft Makes Money

a) Productivity & Business Processes (~30% of Revenue)

-

Microsoft 365 (formerly Office): Subscription-based

productivity suite used by consumers, enterprises, and governments.

-

LinkedIn: Generates revenue through ads, premium

memberships, and recruitment tools.

-

Dynamics 365: Cloud-based ERP and CRM solutions

helping businesses manage operations, customers, and data.

b) Intelligent Cloud (~40% of Revenue – Fastest Growing)

-

Microsoft Azure: A top-tier cloud platform powering

infrastructure, databases, AI, and analytics for global

organizations.

-

Server Products & Cloud Services: Includes SQL

Server, GitHub (used by developers), and developer support tools.

c) More Personal Computing (~30% of Revenue)

-

Windows Licensing: Operating systems sold to device

manufacturers and enterprises.

-

Gaming & Xbox: Hardware, digital content, Game Pass

subscriptions, and game studios (e.g., Activision Blizzard).

-

Devices: Surface laptops, tablets, and accessories.

Revenue distribution across Microsoft's major business segments.

Microsoft's revenue model is highly diversified. While Azure and cloud

services are its growth engines, long-standing products like Windows

and Office remain dominant. Subscriptions and recurring revenue now

drive much of Microsoft’s stability and profitability.

4. Competitive Advantage & Strengths

-

Cloud Leadership –

Azure has become a central pillar of Microsoft's business, powering

digital transformation for organizations globally. With continued

investment in AI infrastructure, hybrid solutions, and global data

centers, Azure remains a major force competing closely with AWS.

-

Dominance in Productivity Software –

Microsoft Office remains the global standard in productivity

software. Its transition to Microsoft 365 has ensured recurring

revenue through subscriptions, while Teams, Word, Excel, and Outlook

are indispensable in corporate environments.

-

Strong Presence in Enterprise Services –

Microsoft’s acquisition of LinkedIn, GitHub, and its focus on

Dynamics 365 for CRM/ERP systems give it an edge in enterprise

connectivity, development tools, and cloud-based business

operations.

-

Diversified Revenue Model –

Unlike companies heavily dependent on one product, Microsoft earns

from multiple areas: software, cloud, devices, gaming, and

enterprise services. This reduces risk and increases resilience.

-

Security & Trust –

Microsoft invests heavily in cybersecurity and compliance, which

appeals to governments and large organizations. Its security tools

integrate across Windows, Azure, and 365 platforms, reinforcing

trust.

5. Strategic Ecosystem & Partnerships

Microsoft operates within a vast and interconnected ecosystem,

amplified by strategic partnerships and a growing portfolio of

subsidiaries. These alliances and acquisitions allow the company to

expand its technological influence and reach across industries.

Key Strategic Partners

-

OpenAI – Integration of AI capabilities like

ChatGPT into Microsoft products.

-

SAP & Oracle – Cloud infrastructure collaboration

for enterprise solutions.

-

Adobe – Creative Cloud integrations within

Microsoft Teams and Azure.

-

Meta – Collaboration on VR/AR workplace solutions

(e.g., Microsoft 365 in Meta Quest).

-

Sony – Cross-licensing and gaming partnerships

despite console rivalry.

Major Acquisitions & Subsidiaries

- LinkedIn – Professional networking platform.

-

GitHub – Leading code hosting and developer

platform.

-

Activision Blizzard – Major gaming acquisition to

boost Xbox and cloud gaming.

-

Nokia (Devices & Services division) – Acquired in

2014 (though later scaled back).

-

Zenimax Media – Parent company of Bethesda

Softworks (gaming IP).

6. Risks & Challenges for Investors

While Microsoft is a global tech powerhouse, no company is without

vulnerabilities. Investors should be aware of several risks that could

impact its performance and market position:

-

Regulatory Pressures (Especially in Cloud & AI) –

Microsoft is increasingly under scrutiny from regulatory bodies

around the world. Antitrust investigations, especially around cloud

service dominance and large acquisitions (e.g., Activision

Blizzard), pose long-term legal and operational risks. Heightened

scrutiny of AI usage and data handling may also lead to compliance

burdens.

-

Intense Competition – Although Microsoft holds a

leadership position in many segments, it faces fierce competition:

- Amazon (AWS) and Google Cloud in cloud services

- Apple and Google in operating systems and ecosystems

- Slack (Salesforce) and Zoom for collaboration tools

- Sony and Nintendo in gaming

Even small market share shifts in these areas can affect growth

rates.

-

Cybersecurity and Data Breaches – As a major cloud

provider and enterprise software vendor, Microsoft is a prime target

for cyberattacks. A large-scale breach could harm user trust, damage

reputation, and lead to legal or regulatory fallout.

-

Dependence on Key Products – While Microsoft has a

diversified revenue base, a significant portion still relies on:

- Windows licensing

- Office 365 subscriptions

- Azure cloud infrastructure

Disruption in any of these could create earnings volatility,

especially if a strong alternative emerges or macroeconomic

conditions reduce business IT spending.

-

Macroeconomic Factors – Fluctuations in interest

rates, inflation, or global recessionary trends could impact:

- Cloud spending by enterprises

- Hardware sales (Surface, Xbox)

- Advertising revenue from platforms like LinkedIn

Microsoft is exposed to global markets, making it sensitive to

regional instabilities and foreign exchange risks.

7. Future Growth Opportunities

Microsoft’s strategic focus on long-term innovation continues to

position it for substantial growth across multiple industries. Below

are the most promising areas where the company is expected to expand

and strengthen its competitive advantage:

-

Artificial Intelligence (AI) & Copilot Integration

– Microsoft is embedding AI across its products with the

introduction of tools like Microsoft Copilot in Office, GitHub

Copilot for developers, and Azure OpenAI services. Its multi-billion

dollar partnership with OpenAI puts it at the center of generative

AI development, opening new monetization channels and productivity

enhancements for enterprise users.

-

Cloud Expansion via Azure – Azure remains the

centerpiece of Microsoft’s long-term strategy. It continues to gain

market share with enhanced offerings like AI-as-a-service, hybrid

cloud solutions, and cybersecurity infrastructure. As enterprises

shift to digital-first models, Azure’s flexibility and global reach

provide significant growth potential.

-

Gaming & Metaverse Initiatives – Through Xbox Game

Pass, cloud gaming, and the acquisition of Activision Blizzard,

Microsoft is aiming to lead the future of interactive entertainment.

While metaverse hype has cooled, Microsoft continues to explore

virtual collaboration tools like Mesh for Teams, merging VR/AR with

productivity.

-

Sustainability Tech & ESG Solutions – Microsoft is

investing heavily in environmental sustainability, with initiatives

like a carbon-negative goal by 2030. Its Cloud for Sustainability

and ESG compliance tools provide services to organizations aiming to

track and reduce environmental impact—an emerging growth market.

-

Developer Ecosystem Growth – Platforms like GitHub,

Visual Studio, and Azure DevOps help Microsoft foster loyalty in the

developer community. Combined with AI-powered coding tools,

Microsoft’s presence in developer infrastructure is a long-term

moat.

-

Geographic Expansion – Microsoft is actively

expanding its infrastructure into emerging markets like Africa, the

Middle East, and Southeast Asia. These regions are projected to

become significant revenue contributors over the next decade as

digital adoption accelerates.

Microsoft's diversification, deep partnerships, and technological

leadership give it a wide runway for sustained growth. Its ability to

integrate AI across cloud, productivity, and enterprise tools sets the

stage for continued dominance in the digital economy.

8. Conclusion – Why Investors Care

Microsoft has evolved from a traditional software giant into one of

the world’s most diversified and forward-thinking technology

companies. Its strengths span across mission-critical software,

dominant cloud infrastructure, AI innovation, enterprise services, and

gaming. These pillars not only drive recurring revenue but also

reinforce each other, creating a powerful and defensible ecosystem.

The company's strong balance sheet, consistent growth, and commitment

to innovation (especially in AI and cloud computing) make it a

resilient long-term investment. Strategic acquisitions like LinkedIn,

GitHub, and Activision Blizzard have expanded its market reach and

deepened its value proposition across sectors.

While Microsoft faces regulatory pressures and fierce competition, its

ability to adapt—evident in its rapid AI rollout and enterprise

expansion—continues to position it ahead of the curve. For investors

seeking exposure to enterprise technology, cloud services, and

emerging AI trends, Microsoft remains a compelling choice in the

modern digital economy.